19+ Net Pay Calculator Illinois

Youll then get your estimated take home pay an estimated breakdown of your potential tax liability and a quick. Illinoiss flat income tax rate is 495 but no local income taxes.

5861 West Empire Road Freeport Il 61032 Compass

Web Income tax calculator Illinois.

. Web Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck calculator. Are you a resident of Illinois and want to know how much take-home pay you can expect on each of your paychecks. Web The Illinois Salary Calculator is a good tool for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2024 and Illinois State Income Tax Rates and Thresholds in 2024.

After-Tax Income Total Income Tax. Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and. Web Use our simple paycheck calculator to estimate your net or take home pay after taxes as an hourly or salaried employee in Illinois.

Enter your gross income. Web Our income tax calculator calculates your federal state and local taxes based on several key inputs. Just enter the wages tax withholdings and other information required below and our tool will take care of the rest.

Web Use ADPs Illinois Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. For example if an employee receives 500 in take-home pay it will calculate the gross amount that must be used when calculating payroll taxes. Web The Illinois Salary Comparison Calculator is a good calculator for comparing salaries when you are actively looking for a new job if you would like to compare your current salary to your new salary after a pay raise or compare salaries when looking at a new.

Web It will calculate net paycheck amount that an employee will receive based on the total pay gross payroll amount and employees W4 filing conditions such us marital status payroll frequency of pay payroll period number of dependents or federal and state exemptions. Where do you work. Also we separately calculate the federal income taxes you will owe in the.

Web To calculate your net pay or take-home pay in Illinois enter your period or annual income and the required federal state and local W4 information into our free online payroll calculator. Use this Illinois gross pay calculator to gross up wages based on net pay. Marginal tax rate 22 Effective tax rate 1167 Federal income tax 8168.

Web 2023 Illinois Gross-Up Paycheck Calculator. Annual Monthly Biweekly Weekly Day Hour. By using Netchexs Illinois paycheck calculator discover in just a few steps.

Web Use Illinois Paycheck Calculator to estimate net or take home pay for salaried employees. Web Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Illinois. Web Enter your employment income into the paycheck calculator above to estimate how taxes in Illinois USA may affect your finances.

Web Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Illinois. Your household income location filing status and number of personal exemptions. Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the.

Find out how much your salary is after tax. Heres a summary of all you need to know when youre calculating payroll taxes for your. Simply input salary details benefits and deductions and any other necessary information as prompted below and let our tool handle the rest.

Web The stunning Illinois tax calculator helps you calculate how much of your Adjusted Gross Income AGI you will devote to taxes during 2022. Although Illinois has a flat income state tax other taxes such as federal and property taxes might be a. Web You can use our Illinois payroll calculator to calculate all your employees federal withholdings plus any additional taxes your business is responsible for paying.

Where do you work. Web How to Calculate Your Paycheck in Illinois - Netchex. Amount you receivedPay frequency.

Web Illinois Paycheck Calculator For Salary Hourly Payment 2023. Curious to know how much taxes and other deductions will reduce your paycheck. Use our paycheck tax calculator.

Generation Income Properties Inc Generation Income Properties Nasdaq Gipr Investor Presentation March 2023 All Information As Of 12 31 2022 Unless Stated Otherwise Real Estate Investments For Generations Ex 99 March 27 2023

Used 2018 Jeep Wrangler Jk For Sale Near Me Cars Com

Introducing The Gardner Farmdoc Payment Calculator Farmdoc Daily

Used Jeep Cars For Sale In Newton Il Cars Com

Southeast Missouri State University 2014 2015 Admission And Scholarship Guide By Brad Chamness Issuu

Pdf Identifying Factors Affecting Inflation Rate In U S A Under Different Scenarios Sri Lankan Journal Of Banking And Finance

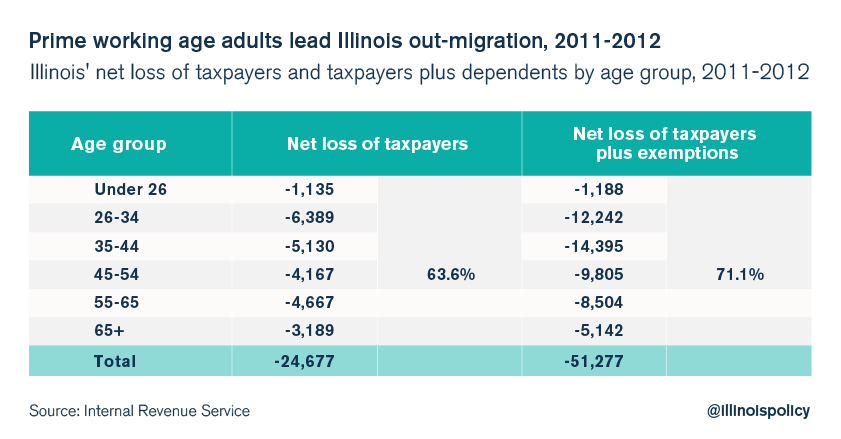

Irs Illinois Is Losing Millennials

Elvis Frederick Cat Fcca Bsc Msc Pacc Branch Manager Communal Co Operative Credit Union Linkedin

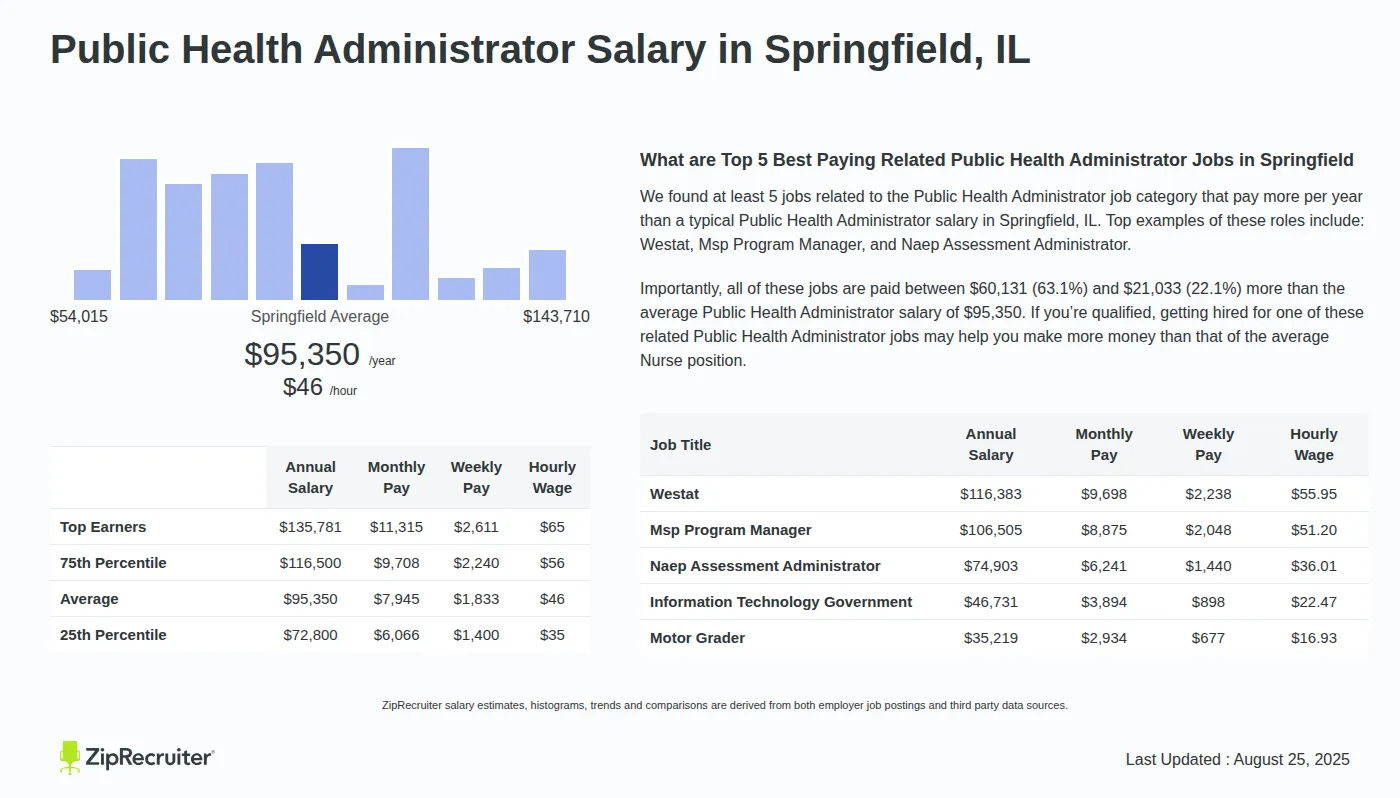

Salary Public Health Administrator In Springfield Il

Introducing The Gardner Farmdoc Payment Calculator Farmdoc Daily

37375 N Il Route 83 Lake Villa Il 60046 Mls 11199159 Redfin

Generation Income Properties Inc Generation Income Properties Nasdaq Gipr Investor Presentation March 2023 All Information As Of 12 31 2022 Unless Stated Otherwise Real Estate Investments For Generations Ex 99 March 27 2023

Course Guide 2018 19 By Barrington 220 Issuu

Illinois Income Tax Rate And Brackets 2019

Global Payroll Calculator

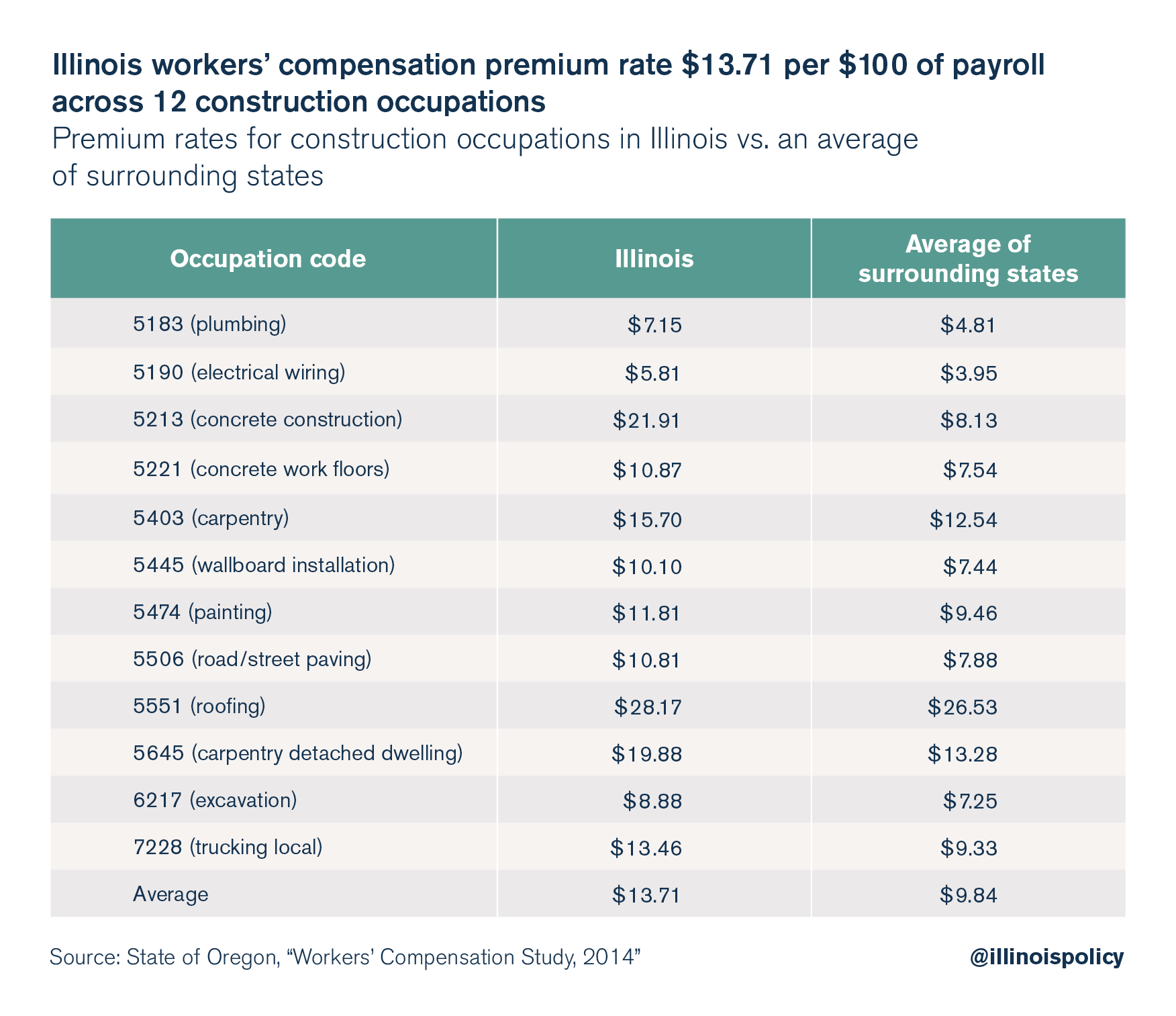

Workers Compensation Estimated To Cost Illinois Taxpayers Nearly 1 Billion Per Year Illinois Policy

0gxaigy2exr0bm